This is Cooper and today, I'm going to talk about withdrawing from your TSP account. This is one of the questions I get more than any other, specifically in retirement. While you're serving and under the age of 59 and a half, you don't have options for withdrawing from your TSP account. You can make loans and such, but actually withdrawing from the account is not allowed. However, when you turn 59 and a half or retire, they give you the opportunity to begin withdrawing or rolling over your TSP account. Many federal employees are unaware of this and don't know the various withdrawal options. I will go over those. The first one is a partial withdrawal. Actually, there are only two withdrawals available: a partial withdrawal and a full withdrawal. I am reading off a headline here, which states that you have two options for withdrawing from your TSP account after leaving Federal service. You may make a partial withdrawal or a full withdrawal. Within the full withdrawals, you have multiple options, but in reality, you only have the option for one partial and one full withdrawal. They give you two options, but it is limited. Let me provide a situation: let's say you have $100,000 in your TSP account. You decide to withdraw $5,000 to repair the roof on your home since you are retired. However, if you want to take out another $5,000 for your car, they will not allow it. You will have to do a full withdrawal instead. After taking the partial withdrawal, let's say for the house repairs, you will have to take out the remaining balance. They offer a couple of different income options for the full withdrawal, but you cannot take out another $5,000 because you already made one partial withdrawal. This...

Award-winning PDF software

Tsp-3 Form: What You Should Know

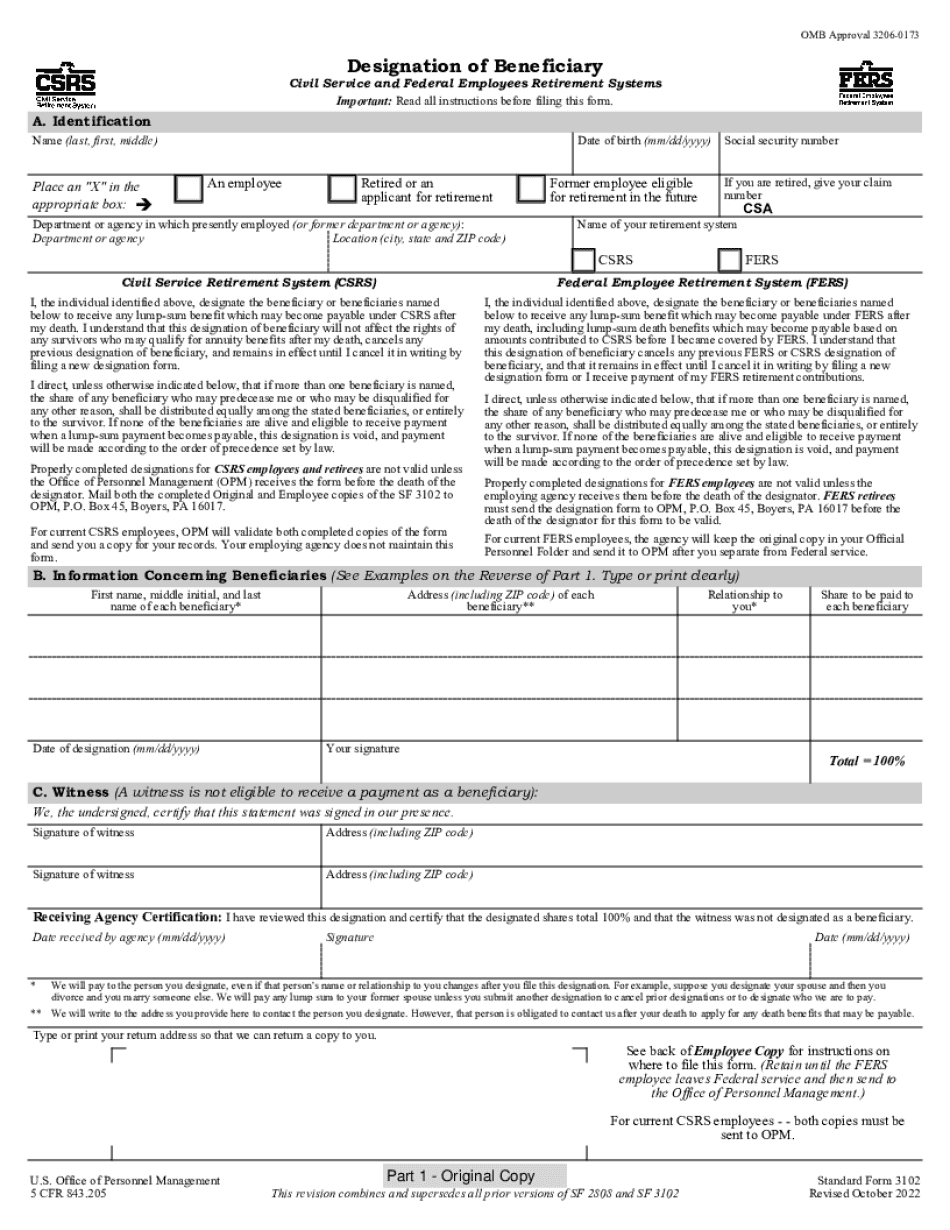

TSP account after your death and to designate the name of the deceased as “Special Serviceman or Marine.” This form is also useful in the event of the death of your surviving spouse. Use the other forms in this folder if you want to department ombudsman — Thrift Savings Plan Use this form to submit a claim for the funds of your civilian Thrift Savings plan. Use this form when you receive an extension of time. Form TSP–9 Use this form to designate a beneficiary by name. Use this form to designate a beneficiary by account number. Use this form when a beneficiary is separated from the department. Use this form to designate a beneficiary by account number and name, instead of the account number in the previous form. Use the other forms in this folder if you want to deactivate the Thrift Savings Plan. Use this form to designate beneficiaries for a deceased employee or employee's spouse to receive civilian Thrift Savings Plan (TSP) accounts after their death. Use this form to designate beneficiaries for the retirement benefit of an employee. Use this form to: designate beneficiaries who will not receive benefits from the Thrift Savings Plan after their release from service (departure benefits). Do not change the account number. Do not designate beneficiaries who are ineligible for tendering. Use this form to designate beneficiaries to receive cash or property transferred to the department during the beneficiary's tenure (other than cash or property that is provided by your agency to your department under the TSP), provided the agency does not retain control over the property. Do not change the account number. Do not require a statement of transference. Use this form to change beneficiaries for a deceased employee or employee's spouse to receive TSP accounts after their death, provided you do not alter the account number, account title, or account type. Do not require a statement of transference. Use this form to increase the number of beneficiaries of a deceased individual's Thrift Savings Plan (TSP) account. Use this form when you terminate the Thrift Savings Plan in favor of a regular 401(k). Use this form to designate beneficiaries to receive disability retirement income in lieu of retired pay, which is taxable income.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sf 3102, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sf 3102 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sf 3102 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sf 3102 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Tsp-3